Describe Methods Used to Verify Inventory

First-In First-Out FIFO method. As background inventory includes the raw materials work-in-process and finished goods that a company has on hand for its own production processes or for sale to customers.

Inventory Control Defined Best Practices Systems Management Netsuite

FIFO and LIFO are accounting methods used to value your inventory and report your profitability.

. In this chapter you will study different types of inventory and how companies use those inventories the costs of different inventory policies inventory-management objectives and performance measures. Some are required frequently while some are not required at all. In periodic inventory you count stock at specific times and add the totals to the general ledger.

An ABC analysis includes grouping different value and volume inventory. Our advanced modeling techniques balance resources and costs against your service goals. Methods of Stock Verification.

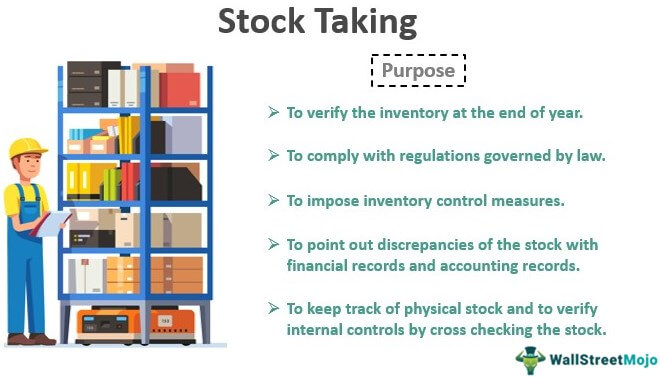

So this method classifies inventory into three categories fast-moving inventory slow-moving inventory and non-moving inventory. Inventory audits can help you calculate accurate profits as the accuracy of your inventory accounting informs your bottom line. Inventory Verification Guidelines Use of students is discouraged.

Last in First out Method LIFO. Check all that apply. Inventory Management Companies make replenishment decisions when managing inventory.

In the perpetual method you record changes in stock as they occur. The retail method assumes that all your inventory has a consistent markup explains Abir Syed CPA of UpCounting. Ad Supply Chain Management Software SCM Software by Logility.

Tackle Multiple Business Operations and Track Sales and Financials with Dynamics 365. Last in first out LIFO method. FIFO first in first out is an inventory accounting method that says the first items in your inventory are the first ones that leave.

Inventory is accounted for using one of three methods. Ad Learn More About the Benefits of Inventory Control. First-in-first-out FIFO costing last-in-first-out LIFO costing or weighted-average costing.

There are three methods of stock verification. In a digital world your inventory audit methods must match. There are four accepted methods of costing items.

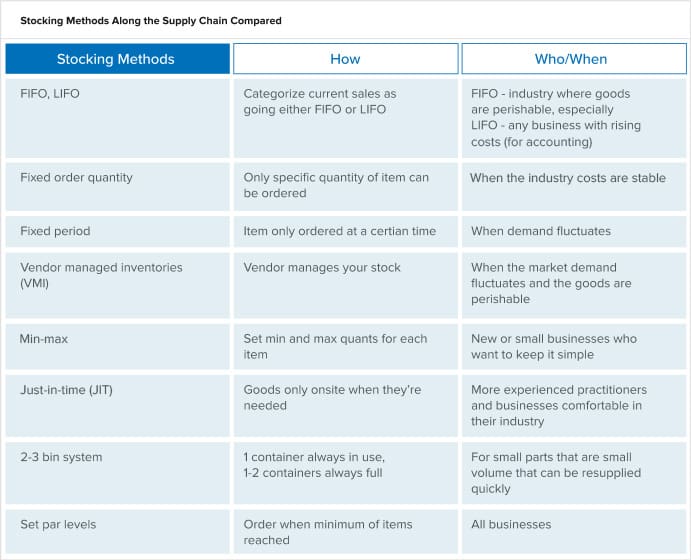

In this section we will explore the most common inventory management techniques used by businesses of all sizes along with the inventory holding costs and potential profits of the most prominent. And d To reveal the weakness of the system if any ie whether the stock is in safe custody. Specific identification is a method of finding out ending inventory cost that requires a.

First in First out Method FIFO. FIFO is a method of valuing the cost of goods sold that uses the cost of the oldest items in inventory first. There are three common methods for inventory accountability in the US.

C To disclose the possibility of fraud theft or loss or deterioration. First in first out FIFO method. Using technology that keeps inventory counts synced in real-time rather than using something static like Excel helps with the following.

Contact us schedule a demo. Methods used to verify inventory. For example high-value inventory mid-value and low-value products can be grouped separately.

Generally Accepted Accounting Principles GAAP allows all three methods to be used. All the inventory items are not used in the same order. Methods of Recording of Inventory.

The two methods of recording inventory are periodic and perpetual. An inventory account typically consists. So you take the.

This method is based on the assumption that goods that are sold or used first are those goods that are bought first. Robert Lockard 4 Inventory Control Methods You Need to Know Inventory System Software. Its the most basic inventory management technique and can be recorded manually on pen and paper or a spreadsheet.

Perpetual inventory management is simply counting inventory as soon as it arrives. The retail method provides the ending inventory balance for a store by measuring the cost of inventory relative to the price of the goods. Inventory count can be ensured by general.

If you apply overhead costs to the inventory valuation then the auditors will verify that you are consistently using the same general ledger accounts as the source for your overhead costs whether overhead includes any abnormal costs which should be charged to expense as incurred and test the validity and consistency of the method used to apply overhead costs to. Describe methods used to verify inventory. B To verify the accuracy of stock records.

Physical inventory count- each inventory is measured before and after movement manually and physically Inventory management systems like ERP are used nowadays to ensure the right count of any kind of inventory movement. Dropshipping is an inventory management fulfillment method in which a store doesnt actually keep the products it sells in stock. Assuming purchase costs are declining and a periodic inventory system is used determine the statements below which correctly describe what is happening to cost of goods sold under FIFO LIFO and weighted average cost flow methods.

The order for new inventory takes place on the basis of the utilization of inventory. Some common inventory audit procedures are. Valuing Inventory Costing Methods Overview.

The four main ways to account for inventory are the specific identification first in first out last in first out and weighted average methods. This is one of the common methods used across retail industry and it is at times coupled with other methods for better control on. The items can be tracked and stored in their separate value groups as well.

If used they should be closely monitored All storage places storerooms lockers attics desk drawers file cabinets should be checked for infrequently used equipment Building andor room discrepancies should be noted on the inventory listing and changes. In essence it determines how much expense to recognize this period versus the next period. When a store makes a sale.

The ABC method is one of the most commonly used inventory control methods in some industries. FIFO is a method of inventory accounting in which the oldest remaining items are assumed to be the first sold. The principle behind FIFO is what comes in first will be handled first and what comes in next waits until the first one is finished.

Inventory Audit Audit Procedures For Inventory

No comments for "Describe Methods Used to Verify Inventory"

Post a Comment